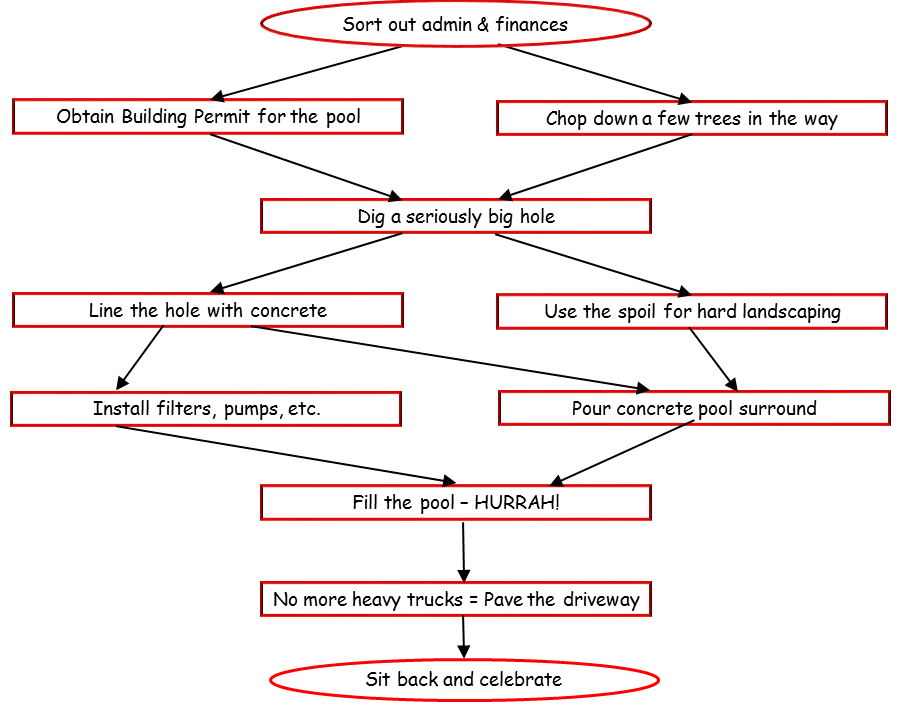

This week we started moving forward on the long-anticipated swimming pool. We signed the contract for the construction, and things are starting to move ahead. There are several interlocking activities, however, as this diagram may explain (all those years of planning projects have some advantages, especially in understanding the necessary sequence of events).

So far, we do not have a clear idea of exactly how long it will all take. As soon as possible, from our perspective. The end of the construction and landscaping work will permit us to finally pave the driveway. All the traffic, the hard cold icy winter and then the wet wet Spring combined to strip away the top layer of “crush and run” gravel exposing much of the underlying larger rocks. Driving up to the road is a heart-stopping adventure of slipping wheels and bouncing rocks. Once the construction traffic has ceased, we can sort it out. Meanwhile, we are arranging temporary repairs with another layer of “crush and run”.

In the forest, new discoveries continue to interest us. The bird feeders are attracting an increasing number of birds (though we take them down at night to discourage nocturnal predators). In particular, the feeders for hummingbirds (dispensing a sugary liquid) are very popular. One small dark coloured bird has taken up almost permanent residence on the bracket above the feeder, chasing off any other hummers that might deign to approach “his” property. At night, every night, the forest is alive with the rattle of the Katydids – a member of the cricket family which makes a very loud noise. And whilst we haven’t seen any more bears (or cows), we did see a young bobcat wandering by. They are a member of the lynx family (with characteristic ear tufts) and this one was size of a large cat. We guessed that it was a year old, out looking for a home of its own and anything edible – but it didn’t find anything of interest so continued on its way.

Robin’s Thoughts on America

Two recent incidents gave me cause to ponder on two of my Thoughts on America. Never let it be said I am dogmatic in my comments!

Additional thoughts – Gun Law

You may remember from thoughts on Gun Laws my unresolved curiosity about the incidence on accidental shooting by citizens. The only recent gun incident in the weekly report of police incidents was in May – a woman bent over to smell some flowers, her derringer pistol dropped out of her bra onto the ground and thereby shot herself in the left leg.

My concern that guns are more liable to result in the owner being injured by their own gun than a criminal act being stopped by said owner was reinforced by a recent press report. A sailor working at a military recruiting site in nearby Gainesville brough his own gun to work (against formal orders prohibiting this) and shot himself by accident.

Case proven?

Additional thoughts – Tax matters

You may remember from earlier this year I commented on the cunning scheme run by the US Government to encourage the population to offer interest free loans to the the Treasury by overpaying their income taxes during the year and getting an interest-free refund a year later. However, I have started to think that this happens due to the inadequacies in the tax collection system which makes such a dubious scheme almost inevitable. At the time I made a comparison at the apparently better structured UK income tax regime.

Recent events makes me question the validity of such a comparison. As my income (various pensions) arises in UK, it is taxed there (and thanks to a dual taxation treaty between UK and USA, I offset my UK taxes against US taxes. For the latest UK tax year, I completed my return promptly, and was advised that I owed the taxman an additional 40 pence. I anticipated that, as is normal, any small discrepancies in tax payment are rolled over the following tax year for settlement. However, I received a stern missive from Her Magesty’s Revenue and Customs that they could not do this because of one of the following reasons:

1 – The inclusion of the underpayment would more than double the tax we normally deduct from your employments and pension. I only wish that I was paying less than £1 tax per year!

2 – You do not have any income from an employment or pension which is taxed under PAYE. In fact, PAYE is deducted from three of my income streams!

3 – You do not have enough PAYE income from your employments or pensions to allow us to collect the tax due. see point 2.

I concluded it would be simpler to pay this massive debt immediately than argue with HMRC (always a bad idea). So I treid to. Unfortunately, my bank would not allow me to pay a sum of less than £1 by electronic transfer. So in the end, I was reduced to hunting out my rarely used cheque book and writing a cheque for the princely sum of £0.40 to the taxman. And yes, it was eventually cashed. I cannot begin the think how much time and effort has been expended generating a totally incorrect letter by HMRC and then subsequently processing a cheque which would not even be enough to buy a Mars Bar.

In conclusion – I reluctantly leave open the question as to whether HMRC is more competent than the American IRS.